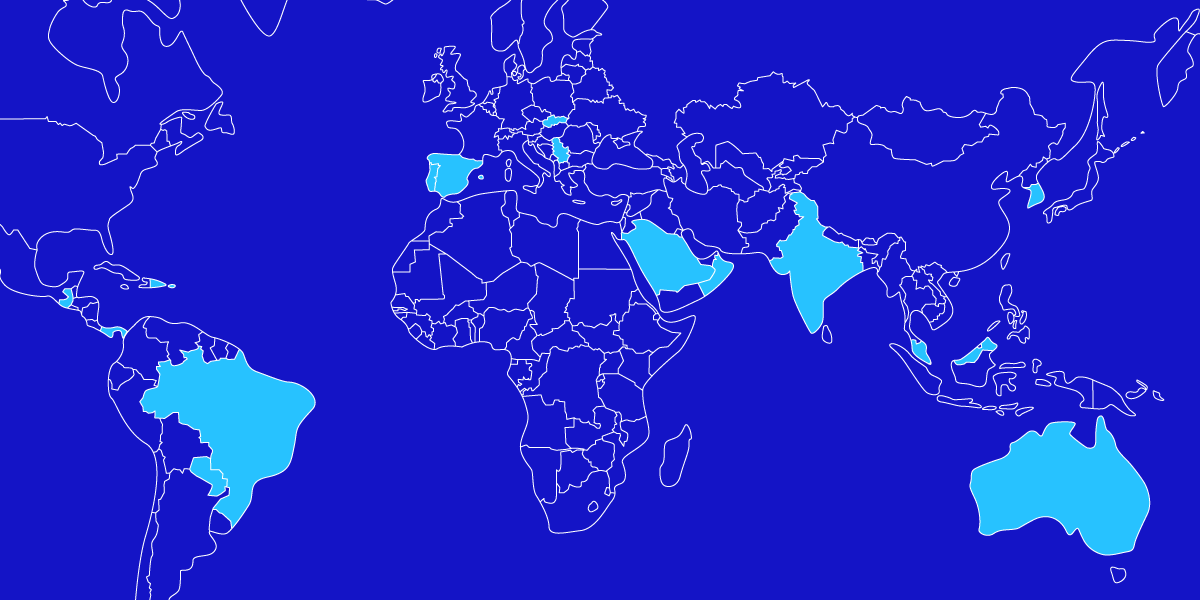

A mandatory electronic invoice is becoming a reality around the world. Let’s review the most important changes in 2023.

For many years, Latin America has been the area where more laws have been passed regarding electronic invoicing. However, it is fair to say that a mandatory electronic invoice has already been implemented in many countries around the world and is a growing trend. Legislations around the world are making progress and the changes that are implemented are moving towards digitalization and automation.

In today’s blog we review the most important obligations we expect to face in 2023, country by country.

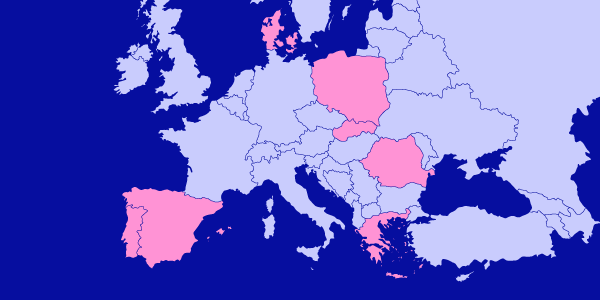

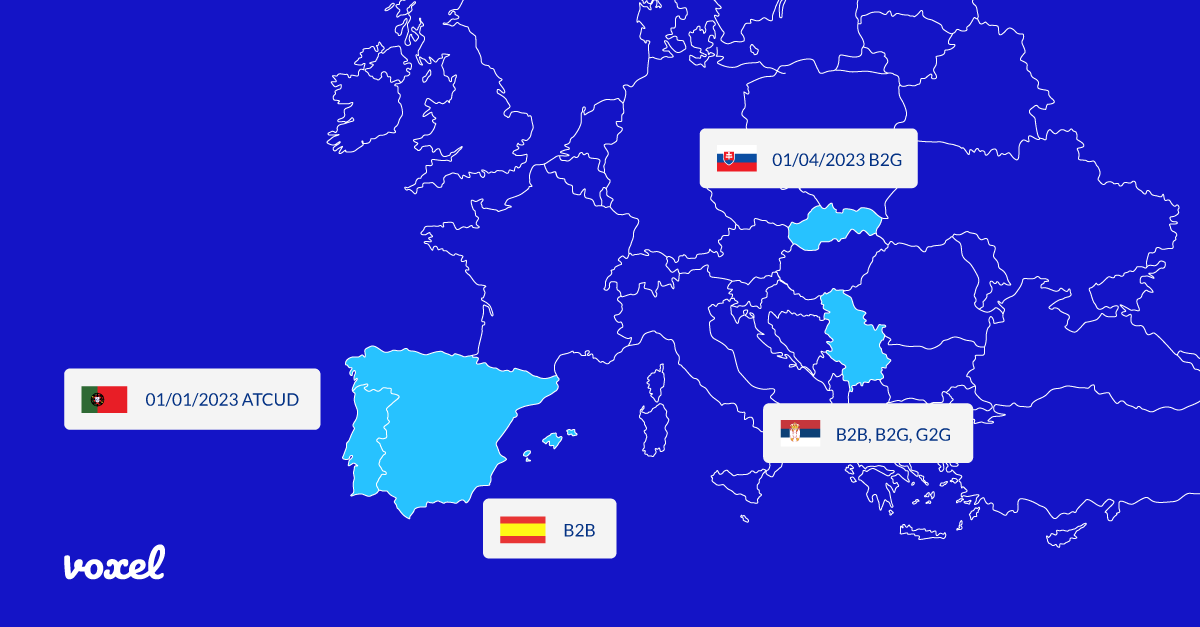

Europe continues moving towards the implementation of a mandatory B2G and B2B electronic invoice

Countries in the old continent are quickly adopting the e-invoice. Take note of the new requirements that are being implemented.

Portugal

Portugal

Beginning on January 1, 2023, all invoices must include the ATCUD (unique identification number).

Serbia

As enacted by the Serbian government in its draft bill to regulate electronic invoices, 2023 will be a key year in the country. Beginning in January, the generation, transmission, reception, processing and filing of invoices must be done electronically. This affects transactions between businesses and government agencies (B2G), between businesses (B2B) and between government agencies (G2G).

This way, Serbia culminates their e-invoice implementation process, which began in 2021, after completing several pilot tests and phases.

Slovakia

For some time now, Slovakia has been promoting the use of electronic invoices. The obligation for B2B transactions will still take a while. However, beginning on April 1, 2023, the e-invoice will be mandatory for B2G transactions.

Spain

The Law “Crea y Crece” (Create and Grow), which regulates the use of electronic invoices in Spain, was enacted on September 22, 2022. The law itself provides a period of 6 months for implementation. This means that in the spring of 2023 the law will be ready and the implementation calendar approved. Businesses with a turnaround in excess of 8 million Euro must implement the electronic invoice before the end of year 2024.

America continues to lead e-invoice implementation

South America is the region where the electronic invoice is more widely used. The laws of each country continue moving towards the implementation of this technology for all types of transactions: B2G, B2B and B2C. Here are the new developments for this year.

Brazil

Brazil

Beginning on January 1, 2023, small businesses and independent contractors must issue electronic invoices using the national system Simples Nacional. Also, the government wants to standardize the method used for issuing e-invoices under standard Nota Fiscal de Serviós Eletrônica (NFS-e).

Panama

The process of implementing electronic billing in Panama has been in the works for years. On January 2, 2023, the third phase of deployment began, with financial institutions transitioning to the e-invoice. The model followed by Panama is very similar to that of other Latin American countries like Mexico or Peru.

Paraguay

The plan to implement the use of electronic invoices for companies began last year. This plan has a total of 10 phases and each phase includes a list of companies who are required to adopt the e-invoice. January 2 is the deadline for one group of taxpayers. The implementation process will be completed in October, 2024. Invoices must be issued in XML format and one of the mandatory requirements is the digital signature.

Guatemala

The plan to implement electronic invoices is near completion in Guatemala. Smaller taxpayers must be issuing electronic invoices by March 31, 2023. This way, the Guatemalan tax authority expects electronic invoicing to be 100% implemented in the country by April 1, 2023.

The Dominican Republic’s plan is already a reality

With the enactment of standard 01-2020 almost 3 years ago, the Dominican Republic began the process of implementing the electronic invoice. Throughout the year 2023, this plan will become a reality, as this is the year when large companies will be required to adopt the e-invoice and become an electronic taxpayer of the DGII (Tax Authority). These large companies will have this entire year to do it. Medium size companies must adopt this system in 2024. And small companies will be required to implement the e‑invoice in 2025.

If your company has an office in the Dominican Republic and you are looking for a trusted partner to connect with the DGII, please visit this page.

Asia is also transitioning to the e-invoice

Just like European countries, Asian countries are taking action, primarily by implementing electronic invoice clearance systems.

India

India

In 2023, practically all businesses in India will be required to issue electronic invoices. The reason is that beginning in January, the threshold above which companies must use the B2B e-invoice will be 5 Indian rupees. Also, B2C invoices (for the end consumer) must include a QR code.

Malaysia

The government of Malaysia has decided to adopt an e-invoice form similar to SdI in Italy. Mandatory implementation of the electronic invoice will begin in 2023; however, a more concrete schedule has not been published.

Oman

Oman is working to promote the mandatory e-invoice. The first step is to establish a legislative framework so companies can use this type of digital document. Beginning in 2023, the electronic invoice will be used voluntarily.

Saudi Arabia

The country is complying with the established e-invoice implementation schedule. This way, beginning on January 1, 2023, phase 2 of the deployment will become effective. This means that all e-invoices must be issued in UBL 2.1 format. The country has chosen an electronic billing clearance system; in other words, communicating with the tax authority in real time. In this sense, B2C invoices must be sent to the tax authority no later than 24 hours after they are issued.

South Korea

Companies with a turnaround between 100 and 200 million Won must issue electronic invoices for B2G and B2B transactions beginning on July 1, 2023.

Oceania is following the trend

Australia and New Zealand are also implementing this technology.

Australia

Australia

The country is adopting this system gradually. In 2022 the e-invoice became mandatory for B2G transactions. In 2023, the government wants to promote the use of e-invoices for B2B transactions and will do so through the “Business eInvoicing Right” (BER) initiative. This way, companies that want to receive invoices in electronic format must request it from BER. Beginning on July 1, 2023, large companies will be required to issue electronic invoices if a request is received. The implementation schedule will be extended until the summer of 2025. Australia uses the Peppol platform.

Voxel’s electronic billing solution, Bavel Billing, enables you to comply with the current laws of each country while automating the issuance and reception of electronic invoices. Voxel is a leading electronic billing company in the international travel sector with more than 50,000 hotels and 1,000 companies in the travel industry subscribed to their network. Voxel also leads the HORECA channel in Spain and is an electronic invoicing supplier for hundreds of companies around the world. If you want to know how we can help you, please visit our website or contact us at [email protected].