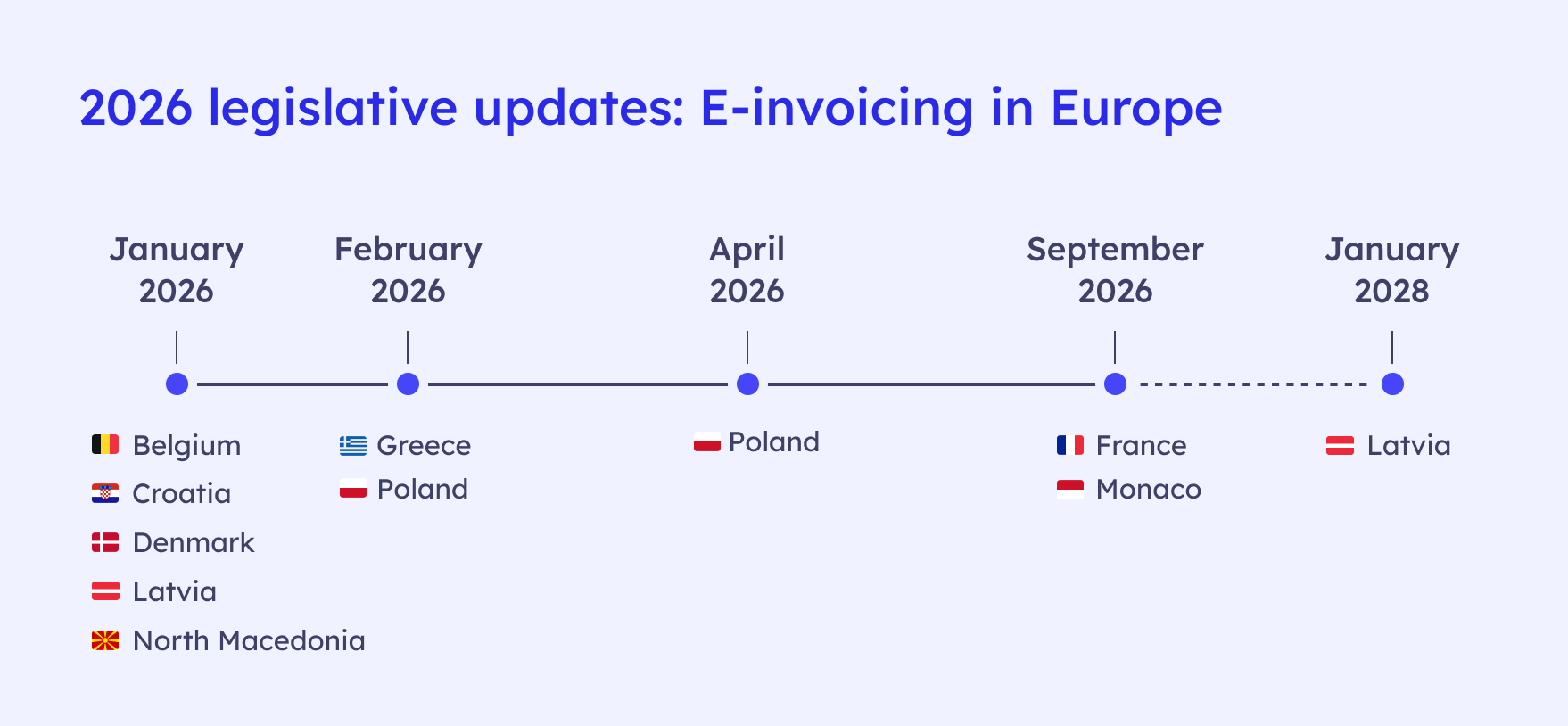

E-invoicing will take center stage in Europe in 2026. New regulations drive digitalization and fiscal transparency, impacting companies of all sizes. Discover the main changes and how to prepare to comply with current legislation in each territory.

Which European countries will implement mandatory e-invoicing in 2026?

Belgium

From January 1, 2026, all Belgian companies subject to VAT must issue and receive structured electronic invoices for B2B transactions. This measure aims to streamline processes and improve fiscal control.

Croatia

Electronic invoicing and reporting will be mandatory for domestic transactions for all VAT-registered companies from January 1, 2026.

Denmark

Companies with turnover above 300,000 DKK must use digital accounting systems compatible with e-invoicing and SAF-T export. SAF-T (Standard Audit File for Tax) is an XML-based file standard used internationally for electronic tax information exchange.

Technical readiness is mandatory, although B2B e-invoicing is not yet required.

Greece

From February 2, companies with revenues above €1 million must issue invoices electronically, with a later phase in October for other entities. Reception will be mandatory for all companies in B2B and B2G environments.

Latvia

In Latvia, reporting electronic invoice data in transactions with the public administration (B2G) will be mandatory from January 1, 2026.

In the B2B sphere, during 2026 and 2027, companies will be able to voluntarily submit electronic invoice data to the administration (e-reporting).

Mandatory B2B electronic invoicing is scheduled for January 2028.

North Macedonia

North Macedonia begins a pilot phase to implement e-invoicing in January 2026.

Poland

From February 1, 2026, large companies must issue and receive e-invoices through KSeF. In April, the obligation extends to all VAT-registered companies.

France and Monaco

From September 1, 2026, all French companies subject to VAT must be able to receive e-invoices. On the same date, large and medium-sized companies will be required to issue e-invoices and perform e-reporting.

In Monaco, the obligation applies to entities registered in France and operating under the French VAT regime.

Why is e-invoicing important in Europe?

Why is e-invoicing important in Europe?

Electronic invoicing streamlines administrative management, reduces errors, and improves efficiency for both private companies and public administration. It also ensures compliance with tax authorities and avoids penalties for non-compliance.

E-invoicing legislation began over 20 years ago in Latin America, where almost all countries have laws regulating these transactions. Now, European countries and the EU are moving towards applying regulations for invoice exchange between companies.

The EU’s ViDA project is an initiative designed to modernize and optimize the VAT system within the European Union. E-invoicing is the engine of digital transformation for VAT management in Europe.

AÑADIR BOTÓN a GUIAS FE

How to prepare for the new e-invoicing regulations?

The regulatory landscape is very heterogeneous depending on the country. The best thing your company can do, if it operates globally, is to prepare in advance.

Having global e-invoicing providers is a first step to face new regulatory challenges. Specialized companies like Voxel have the knowledge and experience to address these changes and guide you towards regulatory compliance and digital transformation of your administrative area.

Want to know how the new regulations affect your company? Voxel helps you implement e-invoicing solutions adapted to European legislation. Contact us!