Belgium, like many other European countries, wants its companies to use electronic invoicing for B2B (business-to-business) transactions. This was confirmed by the Council of Ministers with the approval of the Royal Decree on B2B e-invoicing, marking a milestone in the country’s digital tax transformation: mandatory electronic invoicing for all B2B transactions starting January 1, 2026.

Key features of Belgium’s B2B e-invoicing law

Although Belgium is following the European trend of implementing e-invoicing for B2B transactions—like Italy, France, Poland, and Spain—its model has unique characteristics.

Single implementation date

All companies established in Belgium must comply from the same day. There will be no phased rollout. The regulation mandates that all companies must issue and receive e-invoices starting January 1, 2026.

Mandatory structured format

Peppol-BIS is established as the standard format and Peppol as the central platform. Other formats compatible with the European standard EN 16931 are allowed, provided there is agreement between sender and recipient.

Peppol is a platform that standardizes technical specifications for electronic transactions across countries.

Technical requirements

The technical specifications were published in July 2025. One notable requirement is the new VAT rounding rule, which allows rounding the total amount only by VAT type, not by line item.

Fines and penalties

Fines and penalties

The regulation also sets penalties for companies that fail to meet the technical requirements:

- First offense: €1,500

- Second offense: €3,000

- Subsequent offenses: €5,000

End of PDF via email

Unstructured formats like PDFs will no longer be allowed. Therefore, sending invoices in PDF format via email for domestic B2B transactions will be prohibited.

Other transactions: B2G and B2C

Domestic B2C transactions (to end consumers) are excluded from this regulation. For B2G (business-to-government) invoices, a specific legal framework already exists. B2G e-invoicing has been mandatory since 2020, and was implemented even earlier in Flanders and at the federal level.

For cross-border B2B and B2C transactions, e-invoicing is subject to the recipient’s authorization. A recent guide clarifies that if the recipient is registered in the Peppol network, it is considered implicit consent to receive e-invoices—potentially eliminating the need for bilateral agreements or manual coordination between international business partners.

Who is required to use B2B e-invoicing in Belgium?

The obligation applies exclusively to companies established in Belgium or with a permanent office in Belgian territory.

Companies registered only for VAT purposes without physical presence (infrastructure or staff) in Belgium are excluded. The law applies only to domestic transactions and does not affect cross-border operations.

How does Belgium’s B2B e-invoicing model work?

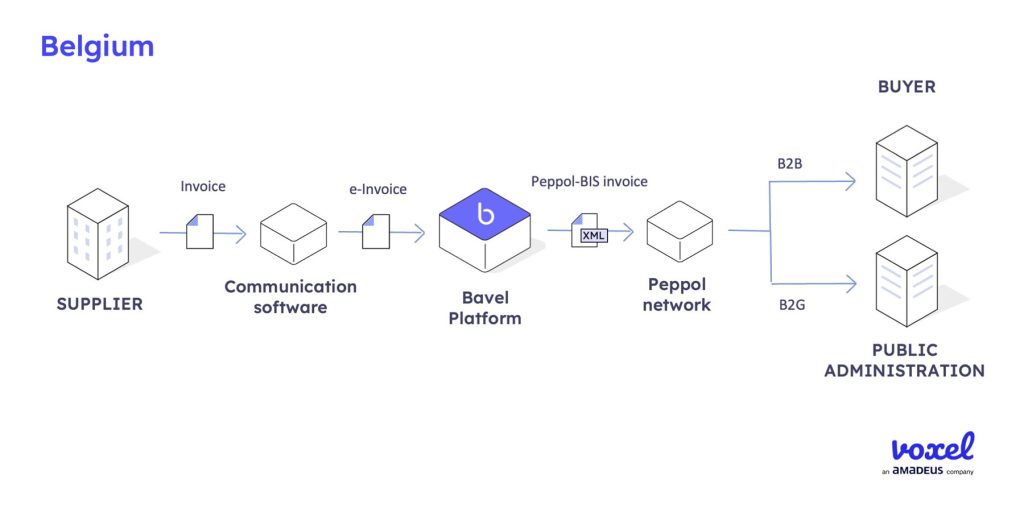

Unlike other countries that have created specific entities like plateformes agréées in France or PIFEs in Spain, Belgium’s entire e-invoicing model is based on Peppol.

Specifically, Belgium uses the four-corner model, where the key players are the invoice sender and their Peppol access point, and the invoice receiver and their Peppol access point. Every Belgian sender and receiver must be connected to a Peppol access point, such as Voxel.

The flow works as follows:

- The hotel issues the invoice, and its Peppol access point sends it to Peppol.

- Peppol identifies the recipient’s access point and delivers the invoice.

- The recipient’s Peppol access point receives the invoice and deposits it into the client’s system.

Beyond B2B e-invoicing: e-reporting in 2028

Beyond B2B e-invoicing: e-reporting in 2028

Aligned with the EU’s ViDA initiative, starting January 2028, Belgium will implement e-reporting, a digital tax reporting system that complements e-invoicing. E-reporting will also be based on Peppol and will include reporting obligations for transactions not covered by the current B2B e-invoicing law, such as domestic B2C and international transactions.

The goals of these digital laws are:

- Optimize tax data collection.

- Combat tax evasion.

- Eliminate annual VAT client declarations.

- Reduce errors and complex administrative processes.

Belgian tax authorities will soon publish the technical and operational requirements for e-reporting.

Voxel: certified provider for B2B e-invoicing in Belgium

As a certified e-invoicing provider, Voxel is already listed on Belgium’s official e-invoicing portal and on the Peppol network. Voxel is the electronic invoicing provider specializing in the travel, hospitality, and restaurant sectors. More than 25 years of experience guarantee our specialization and knowledge of these industries. At Voxel, we help companies take advantage of the digitization opportunity provided by electronic invoicing legislation by digitizing and automating the entire invoicing process.

Beyond B2B e-invoicing: e-reporting in 2028

Beyond B2B e-invoicing: e-reporting in 2028