Electronic invoicing is making great strides across the world. Latin America is the most advanced region regarding implementation of electronic invoicing. However, Europe and Asia are adapting their regulations in order to extend its use. 2020 has seen a great deal of legislation on electronic invoicing postponed due to the Covid-19 crisis. It is therefore important to be keep an eye on developments regarding lawmaking in 2021. Here are the most relevant updates.

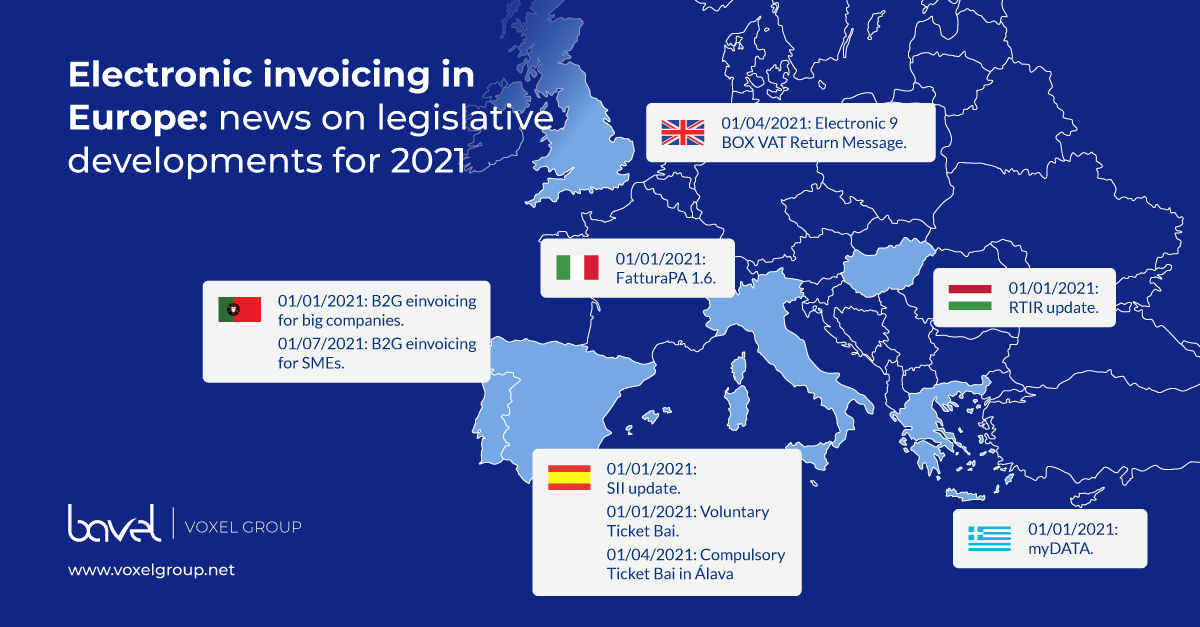

Electronic invoicing in Europe

Italy

Italy

Italy is one of the European countries where electronic invoicing is most widely used. E-invoicing is required for companies in both B2B and B2G transactions. On 1st January, 2021, the new FatturaPA 1.6 technical specifications will come into force.

Portugal

Portugal has been forced to postpone several of its advancements in electronic invoicing because of the coronavirus crisis. The country’s big businesses will finally be required to apply e-invoicing for public administrations—B2G—from 1st January, 2021. This requirement will be extended to SMEs on 1st July.

Hungary

Hungary has updated its Real-Time Invoice Reporting–RTIR regulations. As of 1st January, 2021 all businesses must consequently report B2C and export invoices via RTIR.

Spain

In the Basque Country, the Ticket Bai invoice and ticket management system for business may be used voluntarily in the province of Gipuzkoa as of 1st January 1, 2021. The system will be mandatory for tax advisors in the province of Alava as of 1st April.

A new version of the Immediate Supply of Information on VAT (SII) will come into force nationwide on 1st January, 2021.

Greece

For its part, as of 1st January, 2021 Greece will begin immediate transmission of data to the tax agency through myDATA. Most European countries already use this type of report to keep regular control of company invoices.

UK

One of the MTD–Making Tax Digital project countries, as of 1st April, 2021, UK taxpayers will have to submit “9 BOX VAT Return Message ” electronically.

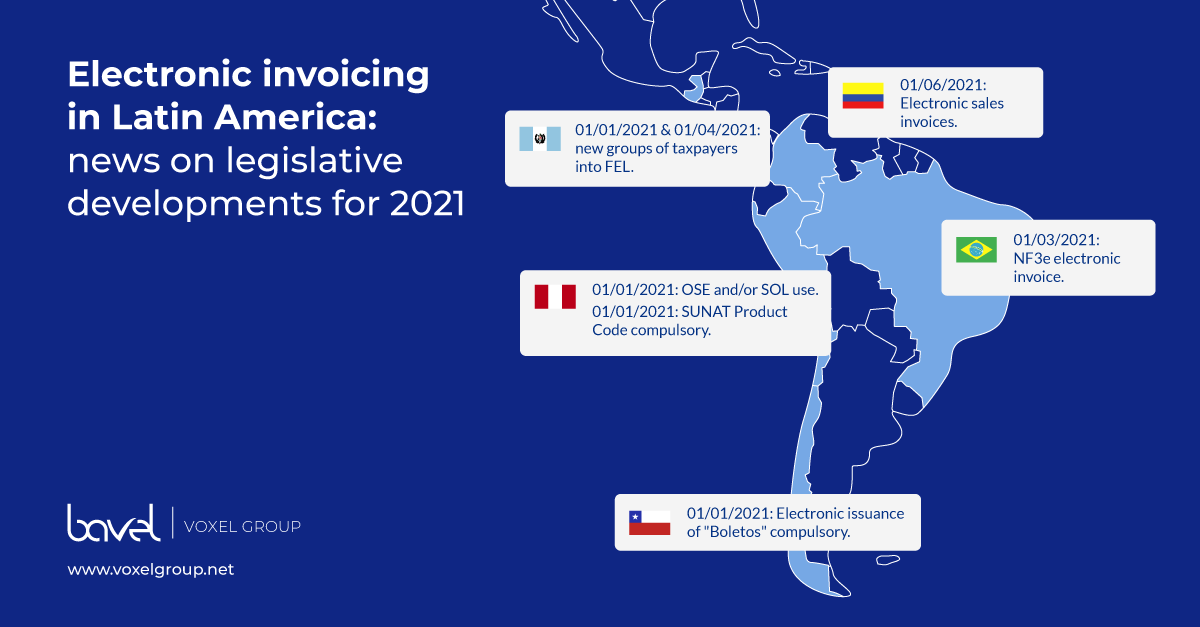

Latin America: moving towards 100% digitization

Chile

Chile

Throughout 2021, issuance of “boletas electrónicas” or electronic tickets will be fully mandatory in Chile. On 1st January, these must be issued to those billing electronically. And on 1st March they will be mandatory for those issuing non-electronic bills.

Peru

Electronic invoicing is being widely implemented in Peru. However, the government is continuing to make updates and modifications to improve the system. In this regard, as of 1st January, 2021 e-invoice issuers will have to apply the OSE and/or SOL. On the same date, the requirement to add the SUNAT Product Code report to electronic payment receipts will come into effect.

In addition, on 1st April, 2021 the new requirements for issuance of e-invoices will come into effect, in accordance with resolution No. 000193-2020.

Guatemala

Throughout the coming year, Guatemala will incorporate new groups of taxpayers into its FEL online electronic invoicing system. The key dates are 1st January and 1st April, 2021.

Brazil

One of the oldest and most robust electronic invoicing systems continues to improve its processes. The NF3e electronic invoice will be mandatory in Brazil as of 1st March. The NF3e is the document that transmits operations relating to electric utilities.

Colombia

Sales invoices will have to be issued electronically in Colombia as of 1st June, 2021.

Digitization of invoices in Africa and Asia

Taiwan

Taiwan

Taiwan has been working on digitizing paper invoices for years. As of 1st January, 2021, only electronic invoices will be valid. That is, those documents that are transmitted by electronic means. The use of electronic invoicing in Taiwan is regulated by the “Uniform Invoice Use Method”

India

Compulsory use of electronic invoicing is also advancing in India. As of 1st January, 2021, all companies with a turnover of over 100 crore rupees per year—approximately 12.6 million euros—will have to issue electronic invoices.

Egypt

As of 15th February, 2021, 347 selected companies will have to use electronic invoicing for B2B transactions. The Egyptian government wants all businesses to do the same by June next year.

Saudi Arabia

Saudi Arabia is committed to a CTC Continuous Transaction Control system, and as of 4th December, 2021, businesses will be obliged to issue their invoices electronically.

If you want to keep up to date on all the legislative news about electronic invoicing throughout the world, subscribe to our monthly newsletter.

You can also visit “The electronic invoicing landscape in Europe” to see the main regulations in Europe at a glance.