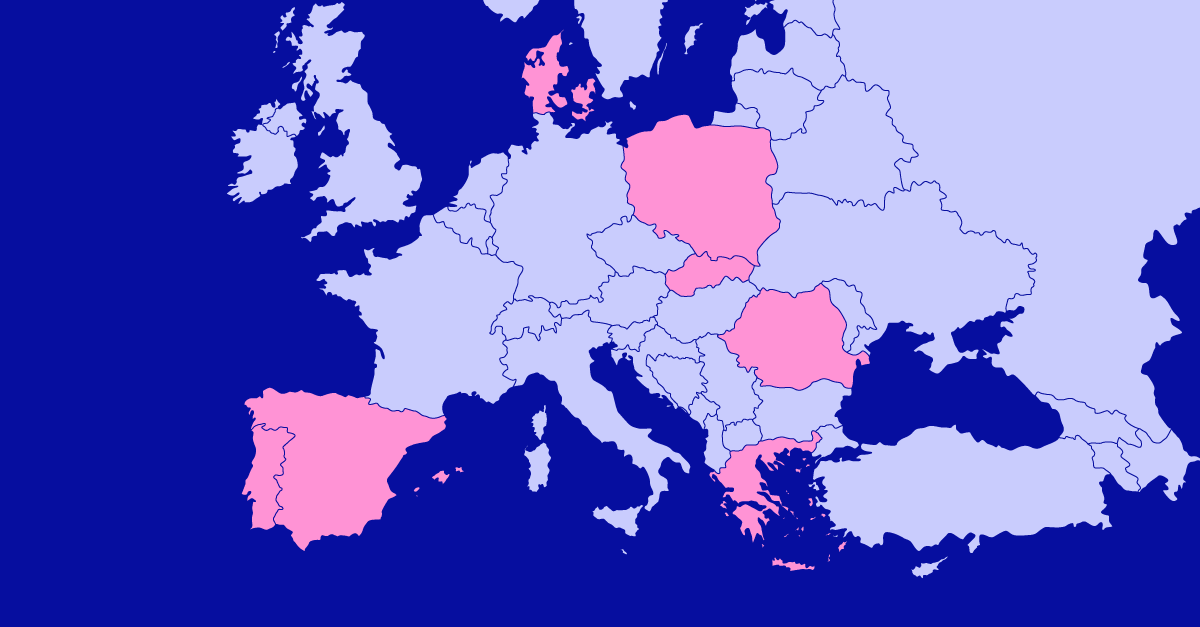

As we start 2024, the European landscape is poised to witness significant legislative advancements in electronic invoicing. Embracing digital transformation is crucial, and staying informed about these changes is essential for businesses seeking to optimize their administrative processes. Let’s delve into the anticipated developments in various European countries:

Denmark: Shaping the Digitalization of Accounting

Denmark takes a bold step in 2024. Companies subject to accounting requirements will be required to digitize their accounting systems from July 1, 2024. Additionally, the Danish Business Authority plans to publish a list of registered digital standard accounting systems in January 2024, simplifying the selection process for companies aiming to comply with evolving requirements.

Greece: A Paperless Odyssey

Greece outlines a meticulous timeline for the implementation of B2G electronic invoicing. By January 1, 2024, all contracts with central government agencies will be obligated to use e-invoices. The obligation progressively extends to other government authorities by June 1, 2024, culminating in a comprehensive transition to a paperless invoicing system covering all government transactions by January 1, 2025.

Poland: Mandate for B2B Electronic Invoicing

Poland’s stride towards electronic invoicing is marked by a law signed on August 4, 2023. This law mandates B2B electronic invoicing through the KSeF system, becoming mandatory from July 1, 2024, for general taxpayers and from January 1, 2025, for small and medium-sized enterprises (SMEs) exempt from VAT. Certain exemptions are in place for business-to-consumer (B2C) invoices and those issued under the one-stop shop (OSS).

*Update: due to the lack of readiness of the IT systems, Poland has postponed the entry into force of the mandatory electronic invoicing without setting new dates.

Portugal: Balancing Voluntariness with Security

Starting January 1, 2024, non-EDI PDF invoices in Portugal must include a qualified electronic signature or seal to be considered valid. While this adds a layer of security, it’s important to note that electronic invoicing remains voluntary in the B2B sector. This nuanced approach ensures a balance between fostering digital practices and respecting business autonomy.

Romania: Advancing in Electronic Invoicing Obligations

Romania: Advancing in Electronic Invoicing Obligations

Romania’s journey towards electronic invoicing obligations takes a significant leap in January 2024. B2B taxpayers, dealing with high tax risk products, are already obligated to submit electronic invoices through the RO e-Invoice system since July 2022. The proposed law suggests extending this obligation to all other taxpayers from January 2024, with a grace period until March 2024 to facilitate the transition.

Slovakia: Gradual Implementation for State and Public Entities

Slovakia charts a phased approach to the implementation of B2G electronic invoicing. In the first quarter of 2024, most ministries and other government entities will transition to electronic invoicing. The dynamic nature of the timeline underscores the commitment to adaptability.

Spain: Decentralized E-Invoicing on the Horizon

Spain envisions a decentralized system for B2B electronic invoices from 2025 onwards. Certified providers (or PIFEs) will play a pivotal role in sending and receiving invoices to comply with the new system. The law is expected to be published in the Official State Gazette (BOE) during 2024, providing businesses with different timelines based on their revenue.

In conclusion, the legislative developments in European e-invoicing for 2024 reflect a collective commitment to digitalization. Adapting to these changes not only ensures compliance but also positions businesses to thrive in an era of seamless, efficient financial processes.

If you want to start digitizing your administrative processes and do not wait until it is mandatory by law, contact Voxel, expert and leader in the travel sector and horeca channel, through the web or directly at [email protected].