Electronic invoicing in France is no longer optional, but mandatory. The law regulating this process is underway, and from September 1, 2026, all companies must begin to adapt to the new system.

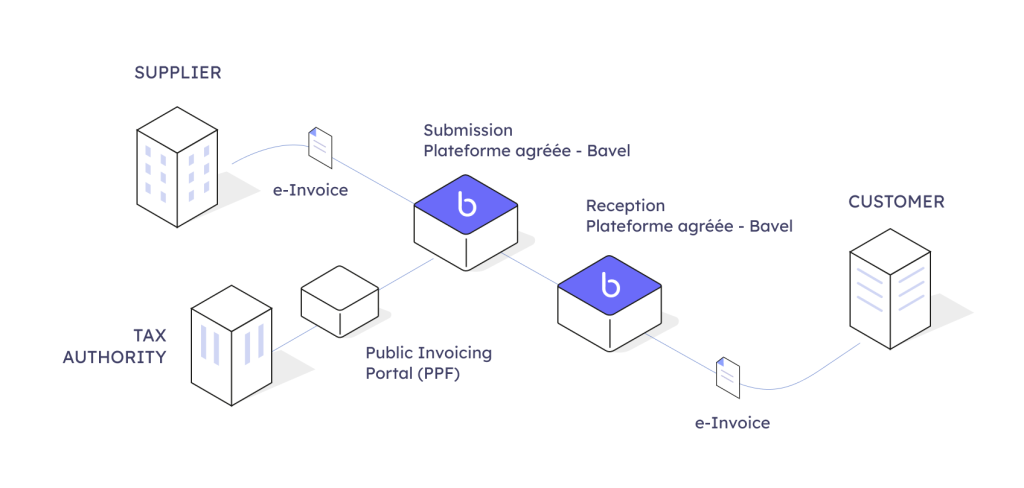

In the French electronic invoicing system, there are four actors: the supplier, the client, technology providers (plateformes agréées, in French), and the government.

As a leading provider in electronic invoicing and B2B payments in the travel sector, at Voxel, an Amadeus company we know how to support hotel chains, travel agencies, bedbanks, TMCs, and other sector players through this change. Not only to comply with regulations, but also to take advantage of all the benefits of digitalization. That’s why today we want to explain in detail the role of plateformes agréées in the law regulating the use of electronic invoices between companies (B2B) in France.

What is a plateforme agréée?

A plateforme agréée is a technology provider certified by the French administration to manage the issuance, technical validation, and transmission of electronic invoices. These platforms comply with the legal requirements established by law and ensure that invoices follow interoperability and security standards.

In other words, they are the trusted intermediary between companies and the Portail Public de Facturation (PPF), ensuring technical conformity and interoperability.

Plateformes agréées were previously called plateformes de dématérialisation partenaires or PDPs.

Why are plateformes agréées mandatory from 2026?

Why are plateformes agréées mandatory from 2026?

The requirement comes from the Loi de Finances, which aims to modernize French taxation, reduce fraud, and increase transparency in business operations.

The French law follows similar models in other European countries, such as Italy. This law establishes that French companies can only issue, send, and receive electronic invoices through an authorized plateforme agréée. Direct issuance and transmission through the public portal is not allowed.

Electronic invoicing is already a reality in France. Companies that do not adapt will be excluded from the system established by law. Therefore, it is necessary for companies to start integrating with a plateforme agréée as soon as possible to ensure a smooth transition.

How does a plateforme agréée work?

The operation of a plateforme agréée can be summarized in four steps:

- Invoice issuance: The company generates the invoice in electronic format and transmits it to the plateforme agréée.

- Validation and conversion: The platform checks that the electronic invoice meets the required legal standards (structure, tax data, authenticity, etc.).

- Transmission to the Plateforme Publique de Facturation (PPF): The platform sends the validated e-invoice to the French state’s central system.

- Invoice reception: The recipient’s plateforme agréée is responsible for receiving the e-invoice sent by the supplier’s plateforme agréée.

As a plateforme agréée specialized in the travel sector, at Voxel we can optimize this flow for this industry. This means we not only connect with the official system, but also adapt the process and invoice information to the specific needs of hotel chains, travel agencies, TMCs, and other travel operators with global operations and specific requirements.

Benefits of working with a specialized plateforme agréée

Benefits of working with a specialized plateforme agréée

Adopting a plateforme agréée should not be seen only as a legal obligation. It should be viewed as a strategic opportunity to benefit from:

- Guaranteed legal compliance: Avoid penalties and ensure the validity of your invoices.

- Operational efficiency: Reduce invoice management times. For example, Pestana Hotel Group reduced its average collection period by more than 15 days thanks to e-invoicing. RIU Hotels & Resorts reduced it by 10 days.

- Greater traceability: Real-time tracking of issued invoices and dispute resolution. According to Voxel data, an international hotel chain can issue between 3 and 6 million invoices per year.

- Digitalization and process automation: Companies not only comply with the law but also gain competitiveness. Hotel chains like Mitsis Hotels have saved more than 6,400 hours per year.

Impact on the travel sector

In this context, the travel sector faces a special challenge: hotel chains, travel agencies, bedbanks, and TMCs, among others, not only deal with domestic invoices but also handle large volumes of international invoices.

With more than 25 years of experience in the travel sector, at Voxel, an Amadeus company we offer solutions tailored to the travel industry, its processes, and daily operations so that these players not only comply with French regulations but also integrate electronic invoicing into their daily operations seamlessly.

Conclusion

The transition to mandatory electronic invoicing in France with a plateforme agréée is a challenge, but also an opportunity. The key is to choose a technology partner who understands not only the law but also the specific needs and operations of each sector.

Benefits of working with a specialized plateforme agréée

Benefits of working with a specialized plateforme agréée