The economic activity of the travel sector has been one of the most affected by the COVID-19 crisis. The rentability of the travel transactions has decreased, payment guarantees have declined and, consequently, credit availability has been reduced to practically zero levels.

In this context, the last session of the baVel Digital Summit was held last October 14th, where key actors of the sector analysed the current situation of the travel sector with data from the last 6 months.

Participants agreed on the industry having to redefine the contracting policies and analyse the businesses’ costs structure, where the financial department will have a key role. In the same way, digitalization and processes optimization will be essential to help mitigate the losses.

New scenarios for the travel sector

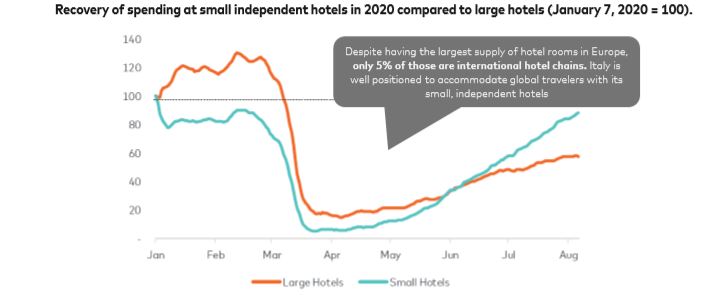

“Covid recovery will vary across sub-verticals, markets and sectors”, assured Ana Arjones, Manager Enterprise Partnerships at Mastercard. According to Mastercard, and based on data of expense recovery in small independent hotels in 2020, the booking volumes in travel agencies has decreased by 75% compared to last year, domestic tourism is recovering its activity, especially in North America, China and Europe. Travellers prefer independent hotels, where security measures and social distancing is easier to maintain.

Source: Mastercard. Agreggated volumes: including debit, credit, national and cross-border.

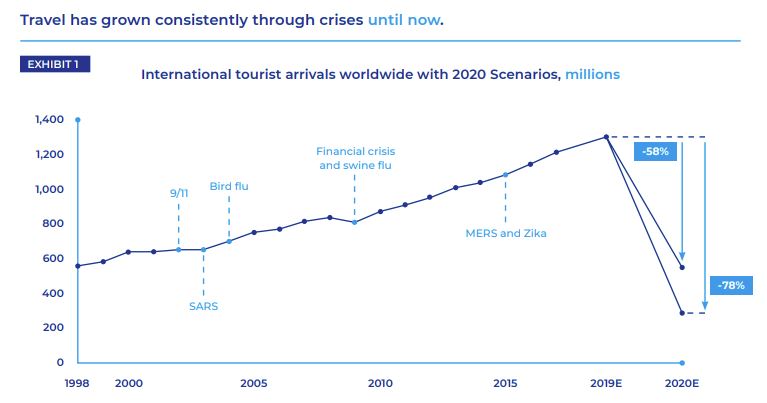

On the other hand, international travel shows slow signs of recovery and is expected than in 6 months recovery will still be under 50%. According to the data of the hotel distributor FastPayHotels, last-minute bookings, millennials and domestic travel has prevailed over long haul and long-distance trips.

Source: World Bank, UN World Tourism Organization (UNWTO), Skift Research estimates. August 2020.

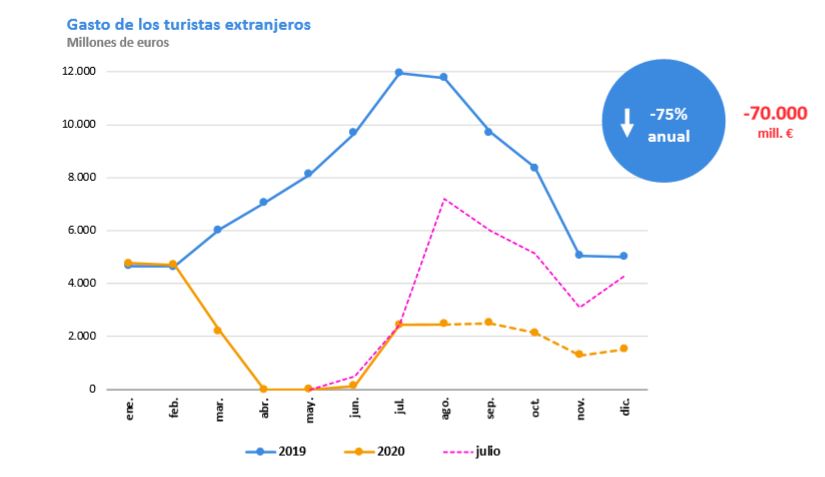

On this line, Pancho Pérez Salazar, Business Development Manager at Comercia Global Payments, outlined the dramatic reduction of the international tourism expense, wherein Spain losses could raise up to 70,000 million euros.

Source: Caixabank, INE.

According to data from FastPayHotels, one of the main challenges the industry will face is lack of credit: “there is less credit in the market. If insurance companies do not provide credit, the travel industry will have to rethink the payment system”, assured Àlex Gisbert, CEO at FastPayHotels.

Digitalization of the financial department

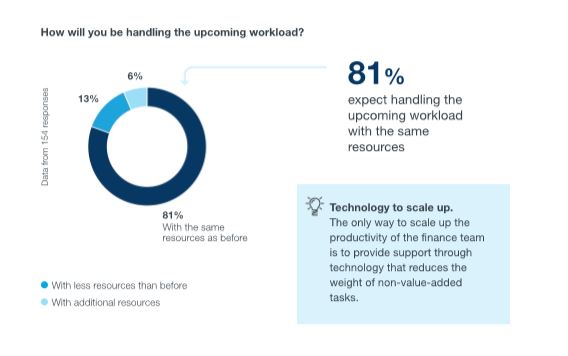

During the talk, participants agreed on the need to optimize the financial department as a key element for the recovery. According to the Fintech Kantox, and looking into last 6 months data, 56% of financial departments that use manual processes expect an increase in the workload in the next 6 months. Furthermore, 81% expect to handle the upcoming workload with the same resources.

Source: Kantox, October 2020.

According to Antonio Rami, Co-founder and Chief Growth Officer at Kantox, it is time to use the paralysis time to optimize operations and internal processes to become more efficient. “Ironically, now is the time to invest and opt for technology and employee empowerment”, outlined Rami.

The event had more than 100 live-viewers. You can watch it again here:

And, remember that tomorrow, October 21st at 4.30 pm, we will present a new session of the baVel Digital Summit: “Exploring payment risk mitigating strategies in the hospitality space”. You can still register here: