The draft bill that will make B2B electronic invoices compulsory in Spain has been passed.

With the aim of promoting economic growth and increase productivity, Spain moves forward in their commitment towards B2B e-invoicing. With this in mind, the Council of Ministers has passed the Draft Bill on Enterprise Start-up and Growth.

The draft bill is included in the Recovery, Transformation and Resilience Plan, an instrument for mitigating the effects of the coronavirus pandemic.

When will the compulsory B2B electronic invoice in Spain become effective?

Once the law enters into force (article 12), the government will pass a regulation containing the specifications of the electronic invoice. Electronic invoices will become compulsory one year after the regulation is approved.

Therefore, the compulsory nature of the B2B electronic invoice in Spain will be implemented in phases:

- Firstly, a year after the regulation is approved, for companies and independent contractors with an annual turnover exceeding 8 million euros.

- Secondly, during the 3 years following the approval of the regulation, for companies with an annual turnover below this threshold as well as for independent contractors.

Everything indicates that in the next 2 years, B2B electronic invoices will become a reality in Spain.

What are the objectives of B2B electronic invoices in Spain?

The promoting of electronic invoicing provides many benefits. From the government’s point of view, one of the elements that e-invoices allows mitigating is the default rate in business transactions. However, there are other objectives: the digitizing of business relationships, lower transaction costs and promoting transparency.

For companies, it provides additional advantages such as fewer errors, improved invoice traceability and quicker payment collections.

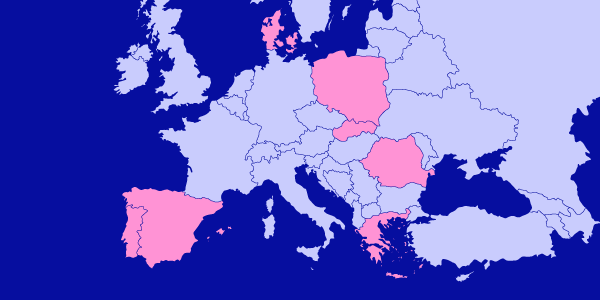

What are other countries doing in terms of electronic invoicing?

Spain is following the model of other European countries that are also considering compulsory measures such as Belgium, Germany or France. The adoption of electronic invoicing in Europe is becoming a growing trend.

If your company is still not using e-invoices and you wish to get ahead of the legislation, please contact us. Send us an email to [email protected] or visit our website. baVel is the benchmark electronic invoicing platform for the travel sector and HORECA in Spain and around the world.

If you want to stay informed about the new legislation, please subscribe to our monthly newsletter.